What Is Not-for-Profit Life Insurance?

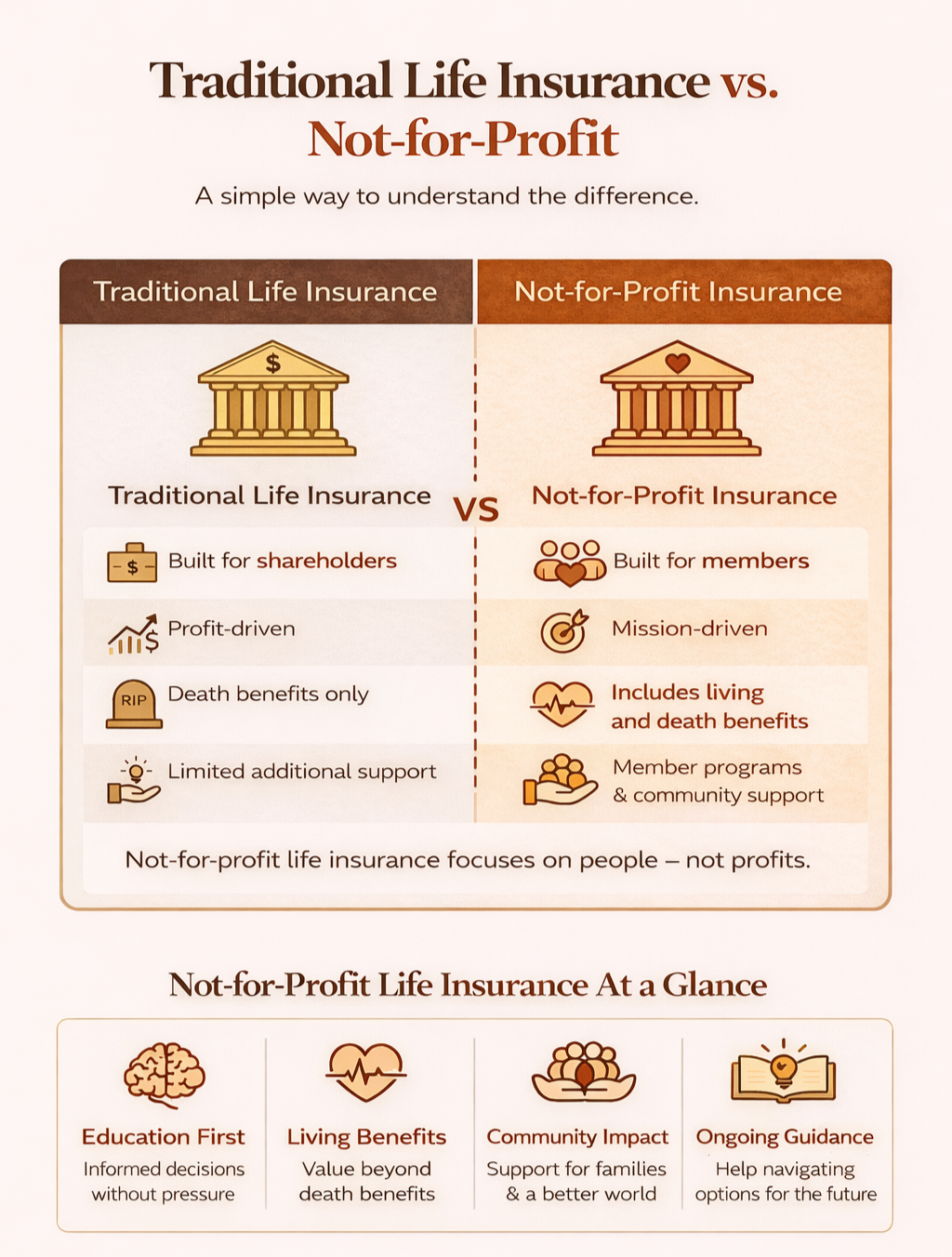

Not-for-profit life insurance is different from the insurance most people are familiar with — and that difference matters.

While traditional life insurance is typically built to generate profits for shareholders, not-for-profit life insurance is structured to serve members, families, and communities. The focus isn’t just what happens after death, but how coverage can provide value and support while you’re living.

The graphics above show these differences clearly. Below, we’ll break down what they mean — and why they matter.

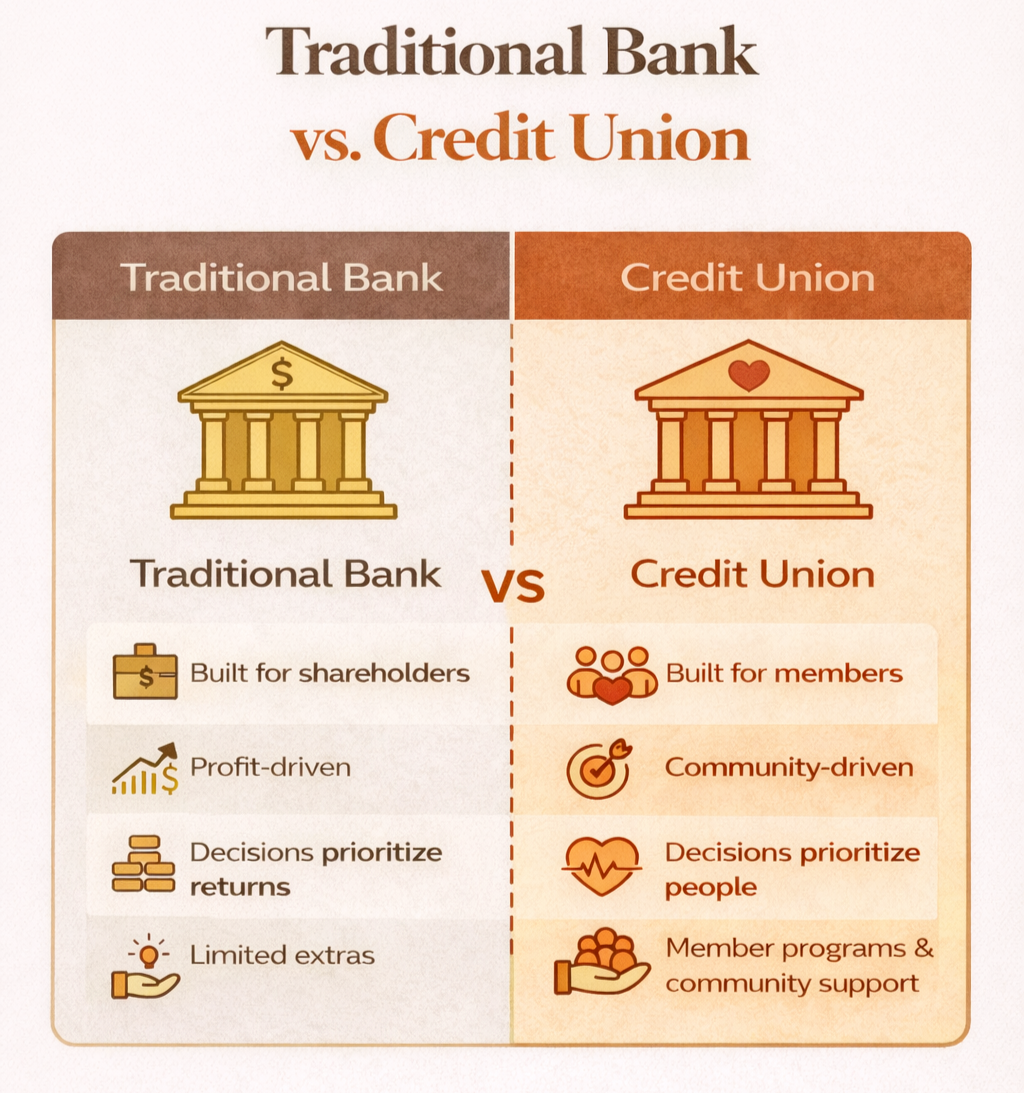

A Helpful Comparison: Banks vs. Credit Unions

If this sounds familiar, it’s because many people already understand this concept through banks and credit unions.

That’s why we use this analogy.

Traditional banks:

Exist to generate profit for shareholders

Decisions prioritize financial returns

Customer benefits are secondary to profitability

Credit unions:

Are member-owned and community-focused

Decisions prioritize people over profits

Offer benefits and programs designed to support members

Not-for-profit life insurance works in a similar way to credit unions.

Just as credit unions reinvest resources back into their members, not-for-profit life insurance organizations reinvest into member benefits, education, and support programs instead of maximizing shareholder returns.

How Not-for-Profit Life Insurance Differs from Traditional Coverage

Traditional life insurance companies operate like most large corporations. Their primary responsibility is to shareholders, which influences how policies are designed, priced, and maintained.

Not-for-profit life insurance organizations operate differently.

Instead of answering to shareholders, they exist to serve their members. That structural difference affects everything — from decision-making to the types of benefits offered. This doesn’t mean one model is “bad” — but it does mean the experience, priorities, and outcomes can be very different.

At a high level:

What “Living Benefits” Really Mean

One of the biggest differences — and most misunderstood — is the concept of living benefits.

Traditional policies are often designed with one primary outcome: a payout after death.

Not-for-profit life insurance may include benefits and programs that provide value while you’re alive, depending on your policy, eligibility, and state regulations.

These may include:

Educational or scholarship programs

Wellness and preventive care support

Community or volunteer grants

Emergency or hardship assistance

Availability varies, which is why education and review are so important.

Traditional life insurance

Built for shareholders

Profit-driven decision making

Focuses primarily on death benefits

Limited additional support beyond the policy

Not-for-profit life insurance

Built for members

Mission-driven, community-focused

Includes both living and death benefits

Offers programs, education, and ongoing support

Is Not-for-Profit Life Insurance Right for Everyone?

Not necessarily — and that’s okay.

The goal isn’t to convince everyone to switch, but to help people understand their options clearly.

Some people choose to keep their existing coverage. Others discover they already qualify for benefits they didn’t know existed. Many simply appreciate having clarity without pressure.

That’s why education comes first.

Member-First Decision Making

Because not-for-profit life insurance organizations aren’t driven by quarterly profits, decisions tend to focus on long-term stability and member impact.

That often means:

Slower, more deliberate changes

Emphasis on education instead of pressure

Support that continues beyond enrollment

This approach is designed to help members understand their coverage — not rush into decisions.

How We Help

Our role is not to sell a specific product or promote a specific carrier.

We help people:

Understand how not-for-profit life insurance works

Review existing policies for gaps or missed benefits

Explore options available in their state

Make informed decisions at their own pace

There’s no obligation to move forward — only an opportunity to gain clarity.

Want to Learn More?

If you’re curious whether not-for-profit life insurance aligns with your goals, the best place to start is a conversation.

You can:

Both options are educational, pressure-free, and focused on helping you understand what’s possible.